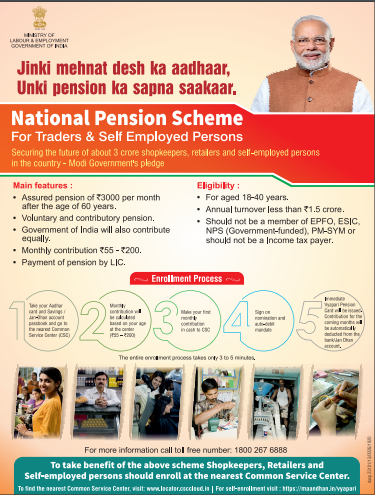

National Pension Scheme for Traders and Self Employed Persons Yojana is a

government scheme meant for old age protection and social security of

Shopkeeper’s, Retail traders and Self Employed persons.

Eligibility

- For self employed shop owners, retail owners and other vyaparis

- Entry Age between 18 to 40 years

- Annual turnover should not exceed Rs 1.5 crore

Features

- Assured Pension of Rs. 3000/- month

- Voluntary and Contributory Pension Scheme

- Matching Contribution by the Government of India

Benefits to the family on death of an eligible subscriber

During the receipt of pension, if an

eligible subscriber dies, his spouse shall be only entitled to receive

fifty per cent of the pension received by such eligible subscriber, as

family pension and such family pension shall be applicable only to the

spouse.

Benefits on disablement

If an eligible subscriber has given

regular contributions and become permanently disabled due to any cause

before attaining his age of 60 years, and is unable to continue to

contribute under this Scheme, his spouse shall be entitled to continue

with the Scheme subsequently by payment of regular contribution as

applicable or exit the Scheme by receiving the share of contribution

deposited by such subscriber, with interest as actually earned thereon

by the Pension Fund or the interest at the savings bank interest rate

thereon, whichever is higher.

Benefits on Leaving the Pension Scheme

- In case an eligible subscriber

exits this Scheme within a period of less than ten years from the date

of joining the Scheme by him, then the share of contribution by him only

will be returned to him with savings bank rate of interest payable

thereon.

- If an eligible subscriber exits

after completion of a period of ten years or more from the date of

joining the Scheme by him but before his age of sixty years, then his

share of contribution only shall be returned to him along with

accumulated interest thereon as actually earned by the Pension Fund or

the interest at the savings bank interest rate thereon, whichever is

higher.

- If an eligible subscriber has given

regular contributions and died due to any cause, his spouse shall be

entitled to continue with the Scheme subsequently by payment of regular

contribution as applicable or exit by receiving the share of

contribution paid by such subscriber along with accumulated interest, as

actually earned thereon by the Pension Fund or at the savings bank

interest rate thereon, whichever is higher

- After death of subscriber and his or her spouse, the corpus shall be credited back to the fund.

Entry age specific monthly contribution

Entry Age (Yrs)

(A) |

Superannuation Age

(B) |

Member’s monthly contribution (Rs)

(C) |

Central Govt’s monthly contribution (Rs)

(D) |

Total monthly contribution (Rs)

(Total = C + D) |

| 18 |

60 |

55.00 |

55.00 |

110.00 |

| 19 |

60 |

58.00 |

58.00 |

116.00 |

| 20 |

60 |

61.00 |

61.00 |

122.00 |

| 21 |

60 |

64.00 |

64.00 |

128.00 |

| 22 |

60 |

68.00 |

68.00 |

136.00 |

| 23 |

60 |

72.00 |

72.00 |

144.00 |

| 24 |

60 |

76.00 |

76.00 |

152.00 |

| 25 |

60 |

80.00 |

80.00 |

160.00 |

| 26 |

60 |

85.00 |

85.00 |

170.00 |

| 27 |

60 |

90.00 |

90.00 |

180.00 |

| 28 |

60 |

95.00 |

95.00 |

190.00 |

| 29 |

60 |

100.00 |

100.00 |

200.00 |

| 30 |

60 |

105.00 |

105.00 |

210.00 |

| 31 |

60 |

110.00 |

110.00 |

220.00 |

| 32 |

60 |

120.00 |

120.00 |

240.00 |

| 33 |

60 |

130.00 |

130.00 |

260.00 |

| 34 |

60 |

140.00 |

140.00 |

280.00 |

| 35 |

60 |

150.00 |

150.00 |

300.00 |

| 36 |

60 |

160.00 |

160.00 |

320.00 |

| 37 |

60 |

170.00 |

170.00 |

340.00 |

| 38 |

60 |

180.00 |

180.00 |

360.00 |

| 39 |

60 |

190.00 |

190.00 |

380.00 |

| 40 |

60 |

200.00 |

200.00 |

400.00 |